Delivery

Shopping guide

Doesn't suit? No problem! You can return within 30 days

Gift voucher

any value

Gift voucher

any value

You won't go wrong with a gift voucher. The gift recipient can choose anything from our offer.

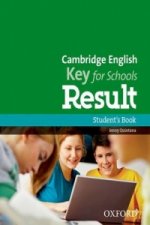

VAT Frauds

English

English

28 b

28 b

30-day return policy

You might also be interested in

The publication addresses up-to-date issues of cross-border economic crime, particularly VAT frauds with emphasis on carousel frauds. Starting with European Union’s legislation in terms of value added taxes and the VAT system functioning within the European Union Member States, it describes various VAT fraud schemes and finally emphasizes European Commission’s proposed solution, i.e. Action plan on VAT. Authors closely looked at cooperation between Member States of the EU, differences in legal definitions of criminal offences in national legislations as well as defined economic crimes connected to VAT system abuses also according to the Slovak Penal Code Act No. 300/2005 Coll. The administrative cooperation tools were elaborated pointing out its weaknesses, which could help to improve the current VAT system which is about to undergo significant changes because of the globalization, dramatically evolving economy, political changes and aggressive business models. Due to this fact, chapters including e-Commerce Directive, electronic invoicing and Carbon credit scheme trading which is mostly driven by fraud, were added. The lack of indicators on intra-Community frauds including Missing trader intra-Community fraud and lack of cooperation between Member States and national authorities were observed, however successful cases were also analyzed, for example JIT VERTIGO including very successful Eurojust’s coordination centres.

About the book

English

English

Categories

How to shop

How to shop